“Catalonia is an excellent place to work, do business, and project yourself in the world”

Jordi Trilles, Revlon's Regional General Manager for Southern Europe

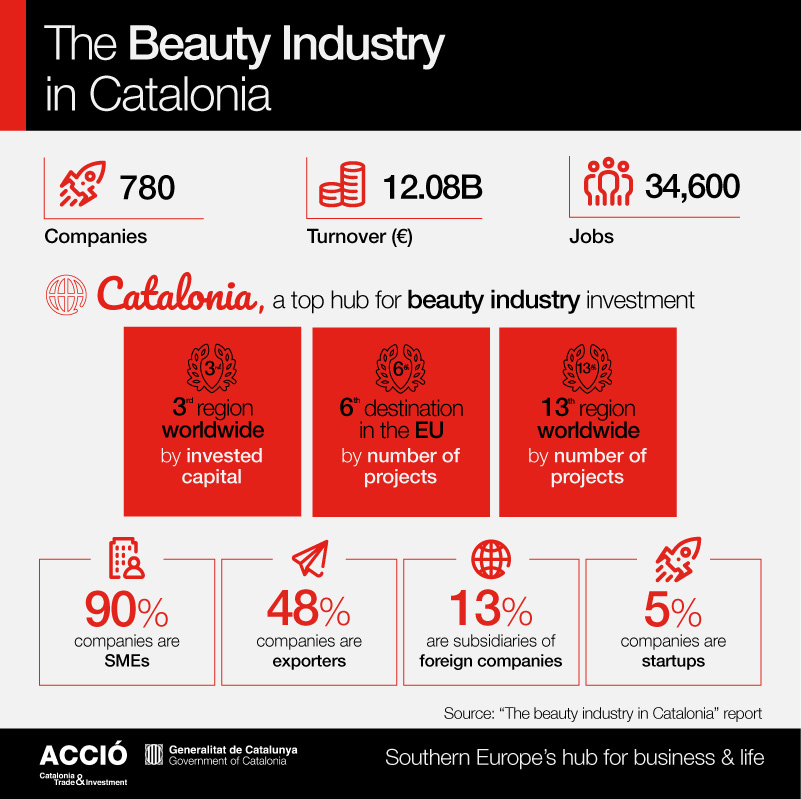

The cosmetics, fragrance, and personal care industry in Catalonia comprises 780 companies that generate a total revenue of €12.1 billion and employ 34,600 people.

Catalonia’s beauty, cosmetics, and personal care industry is made up of 780 companies with a combined turnover of €12.078 billion, representing 4% of Catalonia’s GDP (2023 figures). This is one of the main findings of a study by Catalonia Trade & Investment, which highlights a 35.4% increase in the number of companies over the past six years (since the industry was last analyzed), and a 32.5% increase in turnover. The sector currently employs 34,583 people, growing 18% since the last study.

By business segment, mass-market and dermocosmetics and healthcare show the highest concentration of companies (12% and 11%, respectively). In terms of revenue, fragrances, essences, and perfumes account for the largest share, generating €5.336 billion, or 44% of total revenue, led by Puig Group. The study notes that 75% of total industry turnover is generated by large companies such as Puig. It also highlights that 5% of companies in the sector are startups.

Furthermore, the report emphasizes that the beauty industry in Catalonia has a well-developed support ecosystem made up of business associations, clusters, technology and research centers, and universities offering sector-relevant programs. Catalonia is also home to leading trade fairs and events in this field.

According to the study, Catalonia ranks as the sixth-leading region in the European Union in terms of foreign investment projects in the beauty sector over the last five years (2020–2024). During this period, the region has attracted six projects valued at €26.3 million, creating 276 jobs. These projects include investments from multinational companies such as the US-based Cosmo and Birchbox, Germany’s Beiersdorf, and the UK’s CPL, which have established production or R&D operations in Catalonia. The study further notes that 13% of beauty sector companies based in Catalonia are subsidiaries of foreign firms, underscoring the sector’s openness to international investment.

Additionally, the report finds that Catalonia is the second-largest origin of investment in the EU in the beauty and personal care sector, behind only the Île-de-France region, according to data from the last five years. In total, Catalan firms have invested €809 million in 14 international projects, generating 1,522 jobs.

“Catalonia is an excellent place to work, do business, and project yourself in the world”

Jordi Trilles, Revlon's Regional General Manager for Southern Europe

According to the study, 48% of Catalonia-based beauty sector companies are regular exporters. In 2024, exports in the fragrance and cosmetics sector reached €5.189 billion, a 40% increase over the previous year, marking a historic record. The beauty sector now accounts for 4% of Catalonia’s total exports, and the region represents 60% of Spain’s total international sales in the industry.

In terms of category, fragrances lead with 68% of exports, followed by cosmetics (19%) and personal hygiene products (9%). The main export destinations are the United States (€659 million), France (€523 million), Italy (€343 million), Germany (€343 million), and the United Kingdom (€319 million). Together, these five countries accounted for 42% of Catalonia’s total sector exports in 2024. Along with markets in Asia, Africa, and South America, these regions offer significant international growth opportunities for Catalan beauty companies, according to the report.

The study forecasts that the global beauty and personal care market will grow by around 6% annually, reaching €580 billion in retail sales by 2027. High growth is expected in the Asia-Pacific region, as well as in Europe and North America, while growth in China is projected to slow, although it remains a crucial market.

Several recent trends are expected to shape the sector in the coming years. Consumers are shifting spending habits—prioritizing affordability in some product categories to allow for premium purchases in others. There is a marked rise in ingredient-led beauty and growing overlap with health and wellness (in terms of prevention, nutritional balance, and lifestyle), particularly in areas such as hormonal health and its effects on skin and hair.

Sustainability plays a central role in consumer choices, with demand growing for products that are both socially and environmentally responsible. This trend aligns with new consumption patterns among Generation Z, the rise of new technologies, the digitization of retail channels, and biotechnology-based innovations in active ingredients. The study also notes the sector is undergoing a wave of consolidation, with major companies expanding through mergers and acquisitions.

Opportunities are identified across the raw materials and manufacturing services value chain—areas where Catalonia’s strong industrial base and long-standing cosmetics tradition position it well. These include natural ingredient sourcing, customized manufacturing, and innovative packaging design, such as smart packaging technologies and luxury personalization. Additional opportunities include technological innovation in beauty devices, as well as those connected to channels and sales strategies, with a growing presence of e-commerce and social media-driven sales strategies.

Among the key challenges, the report highlights the need for the Catalan beauty ecosystem to maintain and strengthen its global positioning amid intense international competition. Attracting skilled talent in technical areas will be essential to ensuring the industry’s long-term viability. The sector also faces the challenge of effectively integrating physical and digital sales channels, while adopting industry-wide digitalization, all while maintaining a clear focus on sustainability and differentiation.

780 companies

€12,078M in turnover

34,583 employees

Check below which are the main events, universities, and institutions related to the beauty sector in Barcelona, Catalonia.

23 May 2025

Investing in Digital Health: Why Barcelona-Catalonia is on the Global Map

22 May 2025

Success Story: Why Roche Builds the Future of Digital Health from Barcelona

10 Feb 2025

Success Case: Bayer Barcelona, a Strategic Hub for Innovation and Growth

18 Nov 2024

Success Case: Why Towa Pharmaceutical chose Barcelona for its global headquarters