“Barcelona and Catalonia are the perfect place from which to lead the protein transition”

Bernat Añaños, co-founder of Heura

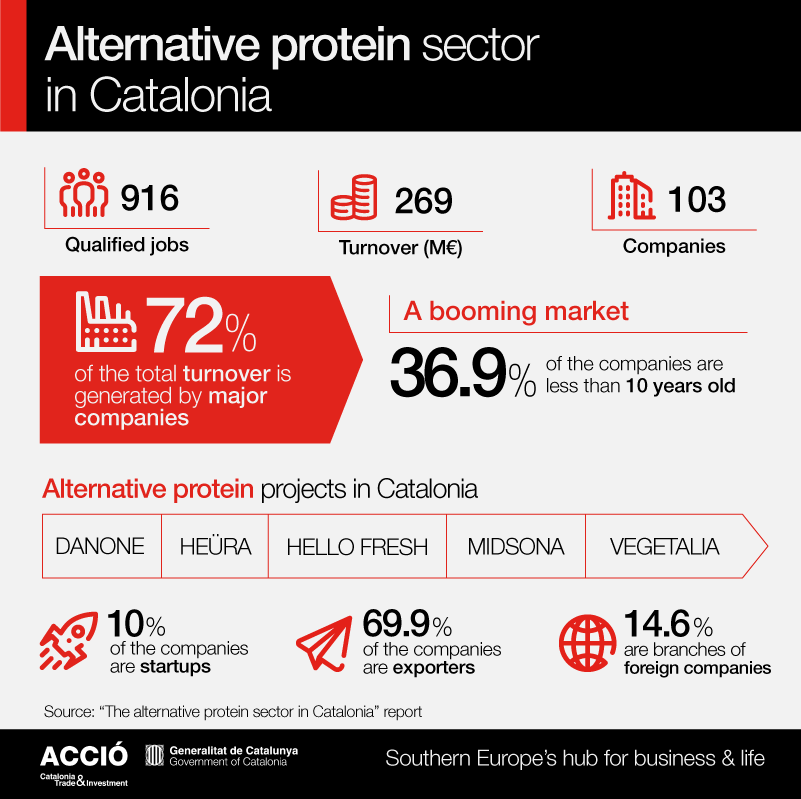

There are 103 companies devoted to alternative protein in Catalonia, according to the first study performed to look into the sector, which also indicates it generates 916 job positions.

The alternative protein sector in Catalonia comprises 103 companies, collectively generating €269 million in revenue. This emerges as one of the key findings from the 'The alternative protein sector in Catalonia' study, offering the first comprehensive analysis of this field, which is forecasted to undergo further expansion in the coming years.

It represents a strategic sector with promising growth prospects: a global market estimated to reach $1 trillion by 2040. In this regard, Catalonia has already established a diverse value chain aimed at capturing a share of this market.

Within the scope of the report, alternative proteins comprise products that are a substitute for animal-derived foods, such as plant-based versions of meat or dairy, fish and seafood substitutes, cell-cultivated meat, and emerging protein sources like insects, mushrooms, or algae.

In this regard, the study highlights that the growth of this sector is attributed to the expanding global population and reflects an upward trend in consuming more plant-based foods. In fact, global sales of these products have surged from $21 billion in 2017 to over $27 billion in 2022.

According to the document, the 103 Catalan companies dedicated to alternative protein generate 916 job positions. The report covers businesses exclusively devoted to alternative protein products (plant-based foods or insects), as well as others within the meat or dairy sector with lines of plant-based products. Additionally, it includes companies specialized in ingredients for enhancing food taste, aroma, and texture, along with those focusing on supplements, among other areas.

The sector is in clear expansion, with 36.9% of the companies involved being less than ten years old and over two-thirds (68%) classified as small and medium-sized enterprises (SMEs). Furthermore, 10.7% of these companies are startups. However, it operates within an international context: nearly 70% of these companies are exporters (with over half doing so regularly), and 14.6% are Catalan subsidiaries of foreign companies.

Moreover, the study emphasizes that Catalonia's alternative protein ecosystem is not only made up of producers but also includes business organizations and associations, clusters, technology transfer platforms, and incubators. It also involves universities, research centers, as well as trade fairs and conferences like Alimentaria or Biocultura, which focus on this area.

“Barcelona and Catalonia are the perfect place from which to lead the protein transition”

Bernat Añaños, co-founder of Heura

103 companies

€269M in turnover

916 employees

Increasingly, foreign companies are ramping up their investments in Catalonia in this field. Meanwhile, the German company Hello Fresh, known for its fresh, ready-to-cook meals, including a plant-based range, is preparing to launch in Barcelona. The Swedish firm Midsona is increasing investment in Vegetalia to produce plant-based meat alternatives. Simultaneously, the Japanese multinational Otsuka, is boosting the capabilities of its nutraceutical product subsidiary, Nutrition & Santé. Additionally, Natural Gourmet Foods has inaugurated a production and distribution facility specifically dedicated to plant-based meat products.

Another aspect analyzed by the Catalonia Trade & Investment study focuses on the business opportunities presented by the alternative protein sector for Catalan companies globally. The document indicates that countries such as Singapore, Canada, China, South Africa, Australia, the Netherlands, or France are undergoing shifts in consumer trends, leading to an increased demand for these products.

However, the report also looks at the challenges confronting the sector. Among these, there's a need to drive technological development so that companies in the alternative protein space can reach production capabilities equivalent to those in traditional food industries. These innovations should also facilitate the exploration of fermentation and cell-cultivation processes to obtain these new products.

Access our report on the alternative protein sector in Catalonia and see the latest trends in the industry.

Take a look below to find out about the main institutions and events in Barcelona-Catalonia related to the Alternative protein sector.

16 Oct 2023

Elian Barcelona, a subsidiary of Viserion International, to acquire a soybean crushing plant in Barcelona

26 Mar 2025

Elian Barcelona: Investing over $100M in sustainable agribusiness in Catalonia

16 Feb 2026

US company Elian lays foundation stone for Barcelona plant-based protein expansion

27 Jan 2021

Report: The Food & Drinks sector in Catalonia, a top destination for international companies